Bookkeeping for Creatives: Simple Solutions to Focus on Your Passion

As a creative freelancer, you’d probably rather spend your time designing, writing, photographing, or creating than tracking expenses and organizing receipts. Yet effective bookkeeping is essential for your business success. This guide will help you find the perfect bookkeeping solution—whether you prefer a simple spreadsheet or sophisticated software—to minimize administrative work and maximize creative time.

Why Proper Bookkeeping Matters for Creative Professionals

Before diving into tools and solutions, let’s quickly address why bookkeeping should be a priority:

- Tax compliance – Avoid stress and penalties during tax season

- Financial clarity – Understand your true profit margins and business health

- Growth planning – Make informed decisions about scaling your creative practice

- Client management – Track payments, invoices, and billable hours effectively

Now, let’s explore the best options for different needs and budgets.

Free Bookkeeping Options for Self-Employed Creatives

DIY Bookkeeping Spreadsheets

If you’re just starting out or prefer complete control, a bookkeeping for self-employed spreadsheet might be your perfect solution. Here’s why many creatives choose this method:

- Zero cost to implement

- Complete customization for your specific needs

- No learning curve if you’re already familiar with spreadsheet basics

- Privacy (your financial data stays on your computer)

Recommended resources:

- Google Sheets offers free templates specifically designed for freelance bookkeeping

- Microsoft Excel has more robust calculation features for complex tracking

- Download our free creative freelancer spreadsheet template with pre-built formulas

Pro tip: Set aside 30 minutes weekly to update your spreadsheet rather than scrambling at tax time.

Free Accounting Software

For more structure than spreadsheets without cost, consider these options:

- Completely free invoicing, accounting, and receipt scanning

- Unlimited income and expense tracking

- Connect unlimited bank accounts and credit cards

- Professional-looking invoice templates for client communications

- Pay only when accept online payments

2.9% + $0.60 per credit card transaction

3.4% + $0.60 per Amex transaction

- Free tier includes unlimited invoicing and vendor management

- Colorful, intuitive interface ideal for visual creatives

- Digital payment acceptance built in

- Simple time tracking for billable hours

- Open-source free software with double-entry accounting

- More powerful for those with some bookkeeping knowledge

- Excellent for detailed expense categorization

- Available for Windows, Mac, and Linux

AI-Enhanced Bookkeeping Software for Creatives

When time is your most precious resource, AI-powered tools can dramatically reduce your bookkeeping burden:

FreshBooks

- AI automatically categorizes expenses and suggests tax deductions

- Captures receipts with your smartphone camera

- Time tracking seamlessly connects to invoicing

- Client portal for professional interactions

- Pricing: $15-50/month (30-day free trial available)

QuickBooks Online with QB Assistant

- Industry standard with powerful AI features

- Ask questions in plain English about your finances

- Automated mileage tracking for on-location creative work

- Connect to thousands of financial institutions

- Pricing: Starts at $30/month (frequent promotions available)

Dext (formerly Receipt Bank)

- Specialized AI for document processing

- Takes the pain out of receipt management

- Extracts key information automatically

- Integrates with most accounting platforms

- Pricing: From $20/month depending on documents processed

Specialized Solutions for Creative Professionals

Some tools are specifically designed with creative freelancers in mind:

AND CO

- Built for the freelance workflow from proposals to payment

- Contract templates protect your creative work

- Time tracking with detailed reporting

- Free version available (paid tier: $18/month)

Bonsai

- All-in-one platform for proposals, contracts, time tracking, and accounting

- Tax assistance includes quarterly estimated payments

- Project management tools integrate with financial tracking

- Client CRM helps manage relationships

- Pricing: From $24/month

Zoho Books

- Excellent for international creatives working with global clients

- Multi-currency support and beautiful client portals

- Automation workflows reduce repetitive tasks

- Free tier for businesses earning under $50K annually

Best Practices for Creative Bookkeeping

Regardless of which tool you choose, follow these principles for bookkeeping success:

- Separate business and personal finances – Open a dedicated business account

- Track expenses in real-time – Don’t rely on memory months later

- Set aside tax money immediately – Aim for 25-30% of each payment

- Schedule regular bookkeeping time – Weekly is ideal, monthly at minimum

- Keep digital records – Photograph or scan all physical receipts

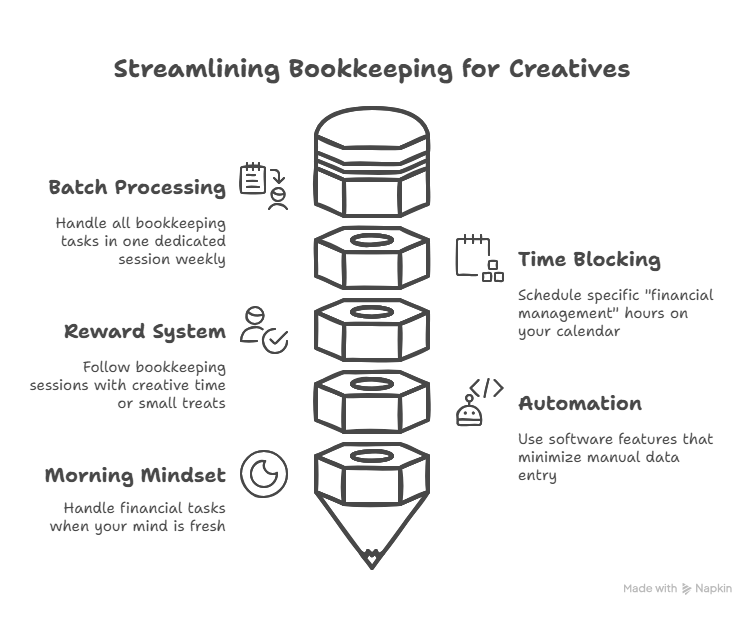

Finding Time for Bookkeeping in Your Creative Schedule

As someone passionate about your craft, finding time for administrative tasks can be challenging. Try these approaches:

When to Consider Professional Help

At certain growth stages, it makes sense to outsource your bookkeeping:

- When your hourly creative rate exceeds the cost of bookkeeping services

- During significant business expansion or new revenue streams

- If tax situations become complex (multiple income sources, international clients)

- When preparing for business loans or investment opportunities

Virtual bookkeepers familiar with creative industries typically charge $30-75/hour.

Conclusion: Focus on Creating, Not Calculating

The best bookkeeping system for creatives is one you’ll actually use consistently. Whether you choose a simple bookkeeping for self-employed spreadsheet or sophisticated AI-powered software, the goal remains the same: minimize time spent on financial administration while maintaining accurate records.

By implementing one of these solutions, you’ll free up mental space and time to focus on what you do best—creating amazing work for your clients.

Which bookkeeping tool works best for your creative practice? Share your experience in the comments below!

FAQs About Bookkeeping for Creatives

Q: How much time should I spend on bookkeeping each week?

A: Most creative freelancers can maintain good records with 1-2 hours weekly.

Q: What’s the biggest bookkeeping mistake creative professionals make?

A: Mixing personal and business expenses, making tax time unnecessarily complicated.

Q: Do I need accounting software if I have an accountant?

A: Yes! Your accountant needs organized data to work effectively. Good software makes this collaboration smoother.

Q: Can I deduct software subscriptions as a business expense?

A: Generally yes, bookkeeping software is considered a legitimate business expense for tax purposes.

Q: What’s the simplest bookkeeping system for absolute beginners?

A: Start with a basic income and expense tracking spreadsheet, then graduate to Wave Accounting when ready for more features.

Post Comment